Well, it’s January once again and saving money is on our minds. That usually means we’re all looking at our bank balances and credit card statement from behind a cushion. But, what are we going to do about it?

When it comes to saving money we are absolutely shocking at it. Christmas always stretches us and if we were a bit better and putting money aside then it would take away the financial stress at a time of year we’re meant to be enjoying ourselves. Of course, saving money is challenging when you have a large family so that is why this year we are giving the penny a day challenge a go.

What is the penny a day challenge

Well, what it is not is saving 1p per day for a year. Let’s face it, £3.65 isn’t going to go very far is it?

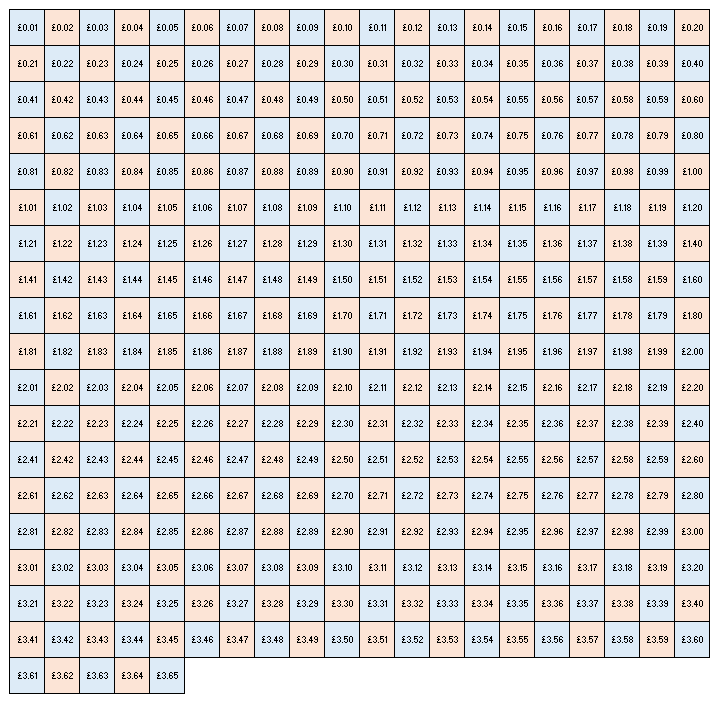

The challenge is to start on the 1st Janaury and put away 1p. Then each day after that you increase the amount you save by 1p. So, on the 2nd January you save 2p, then on the 3rd 3p. On the last day of January you will put away 31p.

By the end of the year, on 31st December, you would put away £3.65 on that day.

In total you would save £667.95 – a nice tidy sum for Christmas.

Simple, eh?

It gets expensive

The reason we’ve never done this challenge though is because it starts to get expensive.

If you follow the process in sequence, in January you would save a total of £4.96. This is a modest sum to save in a month and certainly manageable for most budgets. However, in June you would be expected to save £49.95, then in December a whopping £108.50.

Clearly, following the daily increments will mean that you are shelling out more and more every day, week and month. For us this would not be sustainable.

How we plan to do it

Those of you who have followed thus far can’t failed to have noticed another flaw in the plan. If we need to use this money for Christmas then ideally we need to be cashing out these saving in November at the latest. So getting ahead and completing the grid early would be idea if we can manage it.

We’ve also got a head start on things by emptying the copper savings jar that was bursting at the edges. So we’ve already finished January!

We’re going to play it in a more ad-hoc way. Using the board below we’ll aim to save around £10 to £13 per week and cross off boxes that add up to the total.

This will mean that we’re spreading the savings out across the year and not stretching ourselves.

Clearly this is a more normal approach to saving. However, this method will allow us to flex up and down what we save. If we’re having a lean week then we’ll save 7 amounts from days earlier in the year. Conversely, if we’re a bit flush (haha, yeah right) then we can pick off some of the higher amounts.

Having the savings board to cross off the amounts is where I think this plan will work. Putting that up on the wall and seeing it daily will focus our minds to chip away at it.

Saving money is a balancing act

Our budget is already stretched, so finding money for saving is never easy. We’ve got lots to juggle at the moment, and while saving for Christmas 2019 might not seem like a priority right now it will pay off in the long term.

Resisting temptation to dip

We plan to do this with physical cash rather than on-line banking. It makes sense to use up lose change from out pockets and see the pile grow.

But, we will have to be strong in our resolve never to dip into the savings jar – no matter what. It’s a slippery slope when you start writing IOUs!

Will you join us?

Will you be joining in with us on this method of saving in 2019?

Dave

One thought on “Saving Money: Our 2019 Penny A Day Challenge”